Personal Tax

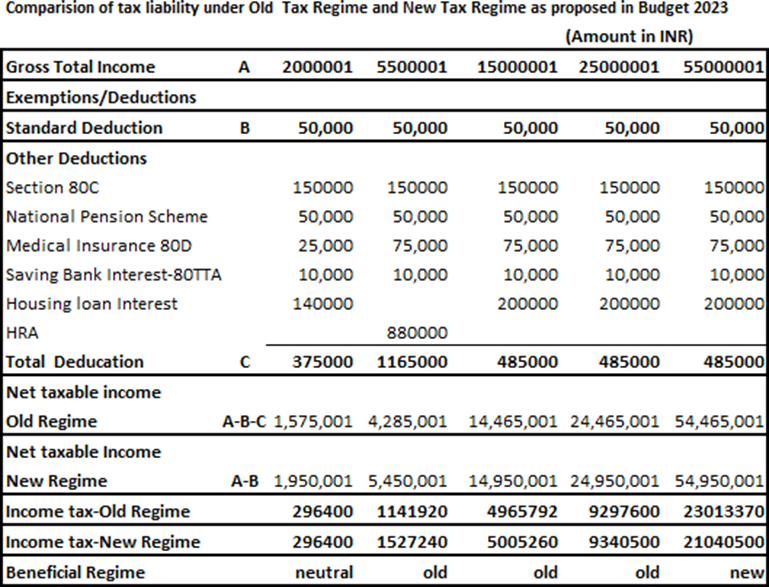

Refer to table below to get the actual impact picture as per analysis as on date from

various sources and govt budget documents . This may change based on ongoing

interpretations

The following Calculations are based on the assumptions:

Section 80C benefit of Rs 1.50 lacs taken in Old Regime

Standard Deduction benefit Of Rs 50000/- taken in Both Old and Revised New Tax Regimes

(Amount In INR)

| Gross salary Income | Tax payable in Old Regime | Tax payable New Regime ( Budget 2023) | Tax saving Old vs Revised New Regime |

| 500000 | NIL | NIL | NIL |

| 600000 | NIL | NIL | NIL |

| 750000 | 23,400 | NIL | 23,400 |

| 1000000 | 75,400 | 54,600 | 20,800 |

| 1250000 | 132600 | 93,600 | 39,000 |

| 1500000 | 210600 | 145600 | 65,000 |

| 2500000 | 522600 | 452400 | 70,200 |

| 5000000 | 1302600 | 1232400 | 70,200 |

| 10000000 | 3148860 | 3071640 | 77,220 |

Section 80C benefit of Rs 1.50 lacs taken in Old Regime

Standard Deduction benefit Of Rs 50000/- taken in Both Old and Revised New Tax Regimes.

Deduction for Mediclaim(including Rs 50000/-Senior citizen parents),NPS, Interest on Housing Loan, HRA allowance considered under Old Regime.

- Further it seems for Senior Citizens old regime will still hold good since they can get more deduction for Interest 80 TTA Rs 50,000.

- Highest surcharge rate to reduce from 37 per cent to 25 per cent in the new tax regime. This to further result in reduction of the maximum personal income tax rate to 39 per cent However, citizens will continue to have the option to avail the benefit of the old tax regime. A lower surcharge of 25% (as against 37%), which would be applicable to those who opt for the new tax scheme, would reduce the tax to about 39% from 42.7%. Chances are quite a few of the well-heeled — the ultra-high net worth (HNIs) in the parlance of wealth managers — would migrate to the new tax plan as other avenues to play around have been closed.

- Provisions for tax on excess of PF Contribution of Rs 7.50 Lacs, Interest on this and Interest earned on employee contribution above Rs 2.50 Lacs remain same

- To commemorate Azadi Ka Amrit Mahotsav, a one-time new small savings scheme, Mahila Samman Savings Certificate to be launched. It will offer deposit facility up to Rs 2 lakh in the name of women or girls for tenure of 2 years (up to March 2025) at fixed interest rate of 7.5 per cent with partial withdrawal option.

- The maximum deposit limit for Monthly Income Account Scheme to be enhanced from Rs 4.5 lakh to Rs 9 lakh for single account and from Rs 9 lakh to Rs 15 lakh for joint account

- To further improve taxpayer services, proposal to roll out a next-generation Common IT Return Form for tax payer convenience, along with plans to strengthen the grievance redressal mechanism.

- Proposed to raise tax exemption on leave encashment on retirement of non-government salaried employees to Rs 25 lakh from Rs 3 lakh. The limit for tax exemption on leave encashment on retirement of non-government salaried employees to increase to Rs. 25 lakh.

- The new income tax regime to be made the default tax regime.

- Prevention of double deduction of interest expenditure – Section 48 ( for capital gain purpose ) of the Act is proposed to be amended to provide that cost of acquisition/improvement of property shall not include the interest already claimed under section 24/Chapter VIA of the Act to avoid double benefit of interest expense.

- Proposed to cap the exemption against Capital Gain u/s 54 and U/s 54F at Rs 10 Crores

- Taxability of the sum received from life insurance policies – It is proposed to provide that any sum received from life insurance policies where the premium payable for the said policies exceeds 5 lacs (individually/in aggregate) during any year would be taxable as ‘income from other sources. However, the same shall not apply to any sum received on the death of a person. Proposal to limit income tax exemption from proceeds of insurance policies with very high value. Where aggregate of premium for life insurance policies (other than ULIP) issued on or after 1st April 2023 is above Rs. 5 lakhs, income from only those policies with aggregate premium up to Rs. 5 lakhs shall be exempt.

- The income from market linked debentures is proposed to be taxed as short-term capital gains at the applicable rates.

- It is proposed to provide that where refund is due to a person, such refund shall be set off against existing demand, and if proceedings for assessment or reassessment are pending in such case, the refund due will be withheld by the Assessing Officer till the date of assessment or reassessment

- Deduction from capital gains on investment in residential house under sections 54 and 54F to be capped at Rs. 10 crores for better targeting of tax concessions and exemptions.

- Conversion of gold into electronic gold receipt and vice versa not to be treated as capital gain.

- Lower TDS on the payment of accumulated balance due to employees under EPF- It is proposed to reduce the TDS rate from the maximum marginal rate to 20% in case of payments to employees in non-PAN cases in line with section 206AA of the Act.

- Deployment of about 100 Joint Commissioners for disposal of small appeals to reduce the pendency of appeals at Commissioner level.

- It is proposed to bring the non-residents under the ambit of section 56(2)(vii)(b) which provides for taxation of any consideration received by a closely held Indian Company for the issue of shares exceeding the fair market value of such shares.

- Countries looking for digital continuity solutions would be facilitated for setting up of their Data Embassies in GIFT IFSC

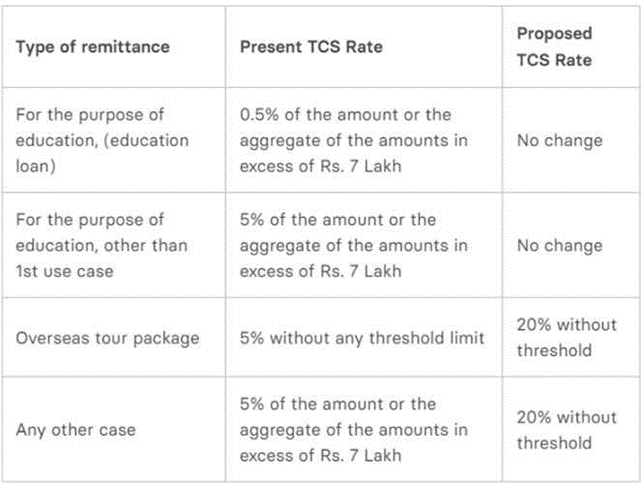

Higher TCS rate for certain foreign remittances effective 1st July 2023

- Rates of TCS increased to 20% for overseas tour program package and foreign remittances other than for education/ medical treatment.

The rate of TCS for foreign remittances for education and for medical treatment is proposed to continue to be 5 per cent for remittances more than INR 7 lakh. Similarly, the rate of TCS on foreign remittances for the purpose of education through loan from financial institutions is proposed to continue to be 0.5 per cent in excess of INR 7 lakh. However, for foreign remittances for other purposes under LRS and purchase of overseas tour program, it is proposed to increase the rates of TCS from 5 per cent to 20 per cent.

How does this impact you from 1st July 2023?

- If you are converting INR to any other currency for the purpose of investment in listed equities or any other purpose: As per the newly proposed Budget 2023, the Bank is required to collect TCS at the rate of 20% on the aggregate remittance amount during a Financial Year. Example: An individual wants to remit and convert Rs. 10 Lakh to US Dollars. The bank would deduct a TCS of 20% on Rs. 10 Lakh. The TCS would be Rs. 2,00,000 in this case.

- If you are converting INR to any other currency for the purpose of an overseas tour package: As per the newly proposed Budget 2023, the Bank is required to collect TCS at the rate of 20% on the aggregate remittance amount during a Financial Year. Example: You want to convert Rs. 10 Lakh to US Dollars for spending on overseas tour/ travel etc. The bank would deduct a TCS of 20% on Rs. 10 Lakh. The TCS would be Rs. 2,00,000 in this case.

- For the purpose of overseas Education, and overseas medical treatment a TCS of 5% will be applicable for an aggregate amount more than INR 7 lacs being remitted.

Note: TCS deducted can be adjusted against the tax payable while filing income tax returns

(ITR).

Other Direct Tax Amendments

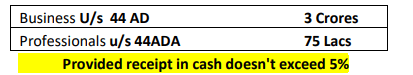

- Proposed to Increase the Presumptive Taxation Limit for MSME

- Deduction for payment to MSME wil be allowed only when actually paid.It will be

allowed on accrual basis only if paid within the time frame as per MSME

Development Act - Proposes mechanism for TDS credit when Income has been already offered to

Taxation in Past - Startups incorporated before 1st April’2024 are eligible for tax benefits as per the

provisions of Income Tax Act - Cooperatives that commence manufacturing activities till 31st ,March 2024 will be

taxed at lower tax rate of 15% - Cooperative can withdraw cash upto 3 Crores without subject to TDS deduction

- Proposes to withdraw the tax exemption to news agency available u/s 10 (22B) of the Income Tax Act

Goods and Service Tax Amendments

- Composition dealers can now supply goods only inter-state through e-commerce operators also.

- Companies can not claim ITC on Inputs used in CSR activities

- Section 23 has been given overriding effect on section 24 retrospectively which means that persons making only exempt supplies and agriculturist now not liable to take registration even though required under section 24(U/s 24 liable being recipient of supplies under RCM)

- GSTR-1, 3B, 8, 9, cannot be filed after 3 years from due date. (Exceptions to be notified)

- 90% of refund to be granted considering provisionally accepted ITC also. (Earlier it was not allowed)

- Penalties for e-commerce operator introduced u/s 122.

- Proposed to decriminalize some offenses (As covered under CPC also)

- Proposed to reduce compounding of fee (As per provisions)

- Supply of warehoused goods before clearance of home consumption amd high seas, Sales not be treated as Supply retrospectively.(no refund to be made if tax deposited)

Disclaimer :This is only for education purpose. Although utmost care has been taken in compiling the provisions but to error is human. Please refer full Budget for reference.

Regards

CA Vaishali Kapoor

Taxavk